All Categories

Featured

Table of Contents

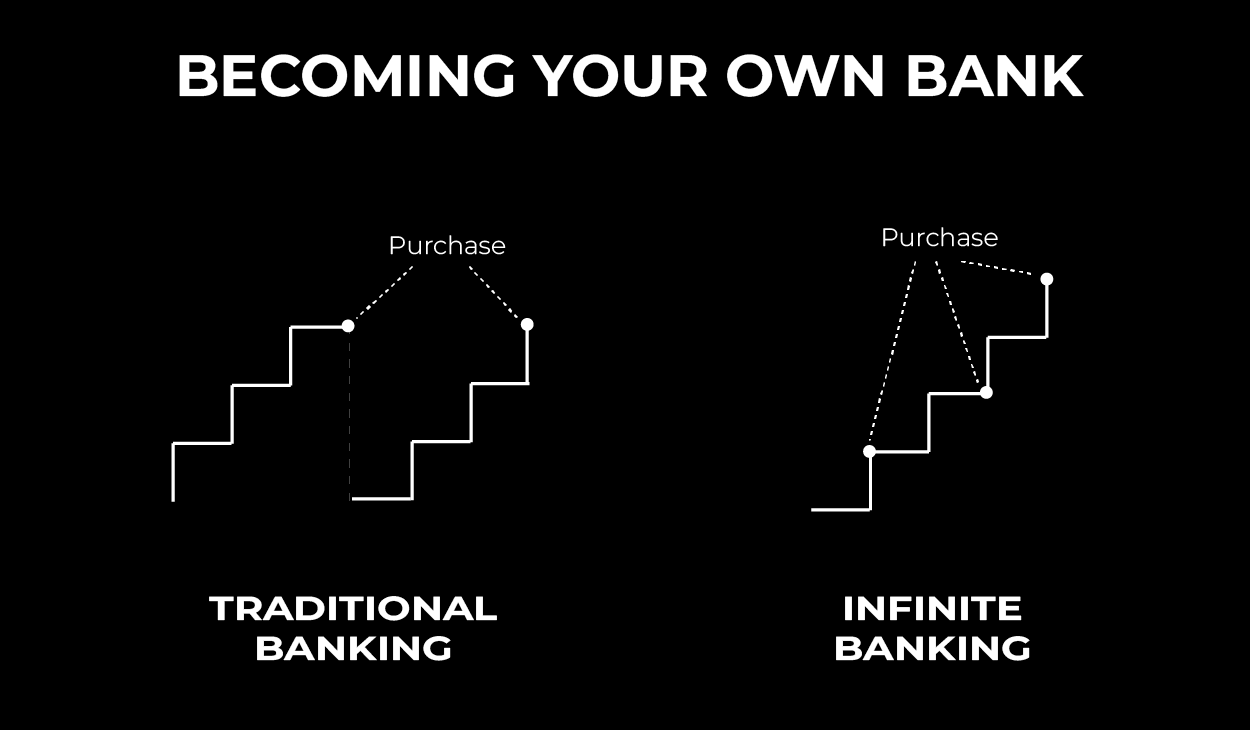

The technique has its very own advantages, but it likewise has concerns with high fees, intricacy, and more, resulting in it being pertained to as a scam by some. Limitless banking is not the very best plan if you need just the financial investment part. The infinite banking principle rotates around making use of whole life insurance policy plans as a financial tool.

A PUAR permits you to "overfund" your insurance plan right as much as line of it becoming a Customized Endowment Contract (MEC). When you utilize a PUAR, you rapidly enhance your cash money value (and your fatality benefit), therefore raising the power of your "financial institution". Even more, the more money value you have, the better your passion and dividend settlements from your insurance provider will be.

By utilizing a whole life policy, families can ensure long-term financial stability.

Unlike traditional savings accounts, Infinite Banking allows families to access funds without penalties.

Insurance brokers assist in structuring Infinite Banking policies - how to use infinite banking to eliminate debt. Speak with a family wealth expert to secure your family’s future for generations

With the surge of TikTok as an information-sharing system, monetary advice and approaches have actually located an unique means of dispersing. One such technique that has actually been making the rounds is the boundless banking concept, or IBC for brief, amassing endorsements from celebs like rapper Waka Flocka Flame - Leverage life insurance. While the technique is currently preferred, its origins map back to the 1980s when economist Nelson Nash presented it to the world.

Cash Flow Banking

Within these policies, the cash value grows based upon a price set by the insurer. When a considerable cash money worth builds up, insurance holders can obtain a cash value financing. These fundings vary from conventional ones, with life insurance coverage serving as collateral, implying one could lose their coverage if borrowing exceedingly without ample cash money worth to sustain the insurance coverage prices.

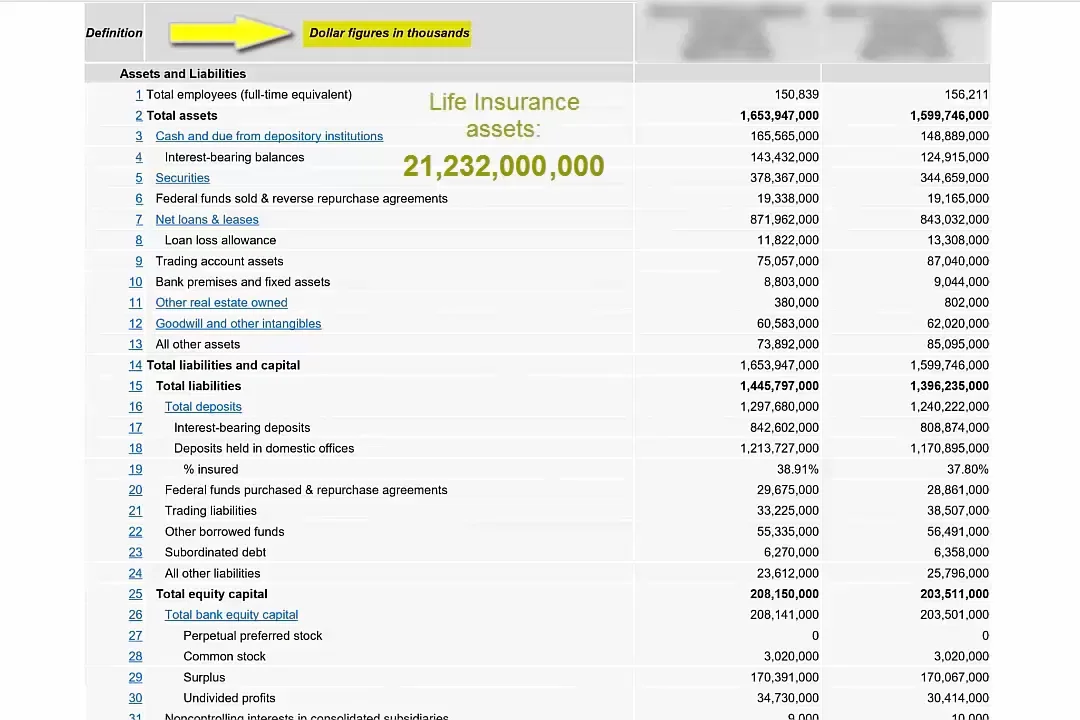

And while the allure of these plans is noticeable, there are natural restrictions and threats, requiring persistent money worth surveillance. The strategy's legitimacy isn't black and white. For high-net-worth individuals or entrepreneur, especially those using techniques like company-owned life insurance policy (COLI), the benefits of tax breaks and substance growth could be appealing.

The allure of boundless financial doesn't negate its challenges: Expense: The fundamental need, a permanent life insurance coverage policy, is costlier than its term equivalents. Eligibility: Not everybody gets approved for whole life insurance due to extensive underwriting procedures that can omit those with certain health or way of life problems. Complexity and risk: The elaborate nature of IBC, coupled with its dangers, might discourage several, particularly when less complex and much less dangerous options are available.

What do I need to get started with Self-banking System?

Designating around 10% of your regular monthly income to the policy is just not possible for most individuals. Part of what you read below is simply a reiteration of what has currently been stated above.

Prior to you get yourself right into a scenario you're not prepared for, understand the complying with initially: Although the idea is frequently offered as such, you're not actually taking a finance from yourself. If that held true, you would not need to repay it. Instead, you're borrowing from the insurance business and have to repay it with passion.

Some social media posts suggest utilizing money worth from whole life insurance policy to pay down credit rating card financial debt. When you pay back the car loan, a portion of that passion goes to the insurance business.

What is the minimum commitment for Infinite Banking Cash Flow?

For the initial a number of years, you'll be repaying the commission. This makes it incredibly tough for your plan to build up worth throughout this time. Whole life insurance coverage expenses 5 to 15 times much more than term insurance. Lots of people simply can't afford it. Unless you can afford to pay a few to numerous hundred bucks for the next decade or more, IBC won't function for you.

Not everyone must rely solely on themselves for financial safety and security. Infinite Banking. If you need life insurance policy, right here are some important suggestions to consider: Take into consideration term life insurance policy. These policies supply coverage during years with substantial monetary responsibilities, like home loans, student fundings, or when caring for kids. See to it to look around for the ideal rate.

What are the common mistakes people make with Private Banking Strategies?

Envision never needing to bother with small business loan or high rate of interest rates again. What happens if you could obtain cash on your terms and construct wealth at the same time? That's the power of limitless financial life insurance policy. By leveraging the money worth of entire life insurance policy IUL policies, you can grow your riches and borrow money without relying upon standard financial institutions.

There's no collection lending term, and you have the liberty to determine on the payment schedule, which can be as leisurely as paying off the finance at the time of fatality. This adaptability encompasses the servicing of the fundings, where you can select interest-only payments, maintaining the funding balance flat and manageable.

Infinite Banking Cash Flow

Holding cash in an IUL repaired account being attributed interest can commonly be far better than holding the money on deposit at a bank.: You have actually constantly desired for opening your very own bakeshop. You can borrow from your IUL plan to cover the initial expenditures of renting an area, buying devices, and hiring personnel.

Individual financings can be obtained from standard banks and credit scores unions. Borrowing cash on a credit card is typically really pricey with yearly percentage rates of rate of interest (APR) often reaching 20% to 30% or even more a year.

Latest Posts

Bank On Yourself Scam

Infinite Banking Concepts

The First Step To Becoming Your Own Banker