All Categories

Featured

Table of Contents

We make use of data-driven techniques to assess financial items and services - our evaluations and rankings are not affected by marketers. Boundless financial has actually captured the interest of numerous in the personal finance world, guaranteeing a path to monetary freedom and control.

Unlimited banking refers to a financial technique where an individual becomes their own lender. The insurance holder can obtain versus this money worth for various monetary demands, successfully lending money to themselves and paying off the policy on their own terms.

This overfunding speeds up the growth of the policy's cash value. The policyholder can then obtain against this cash worth for any function, from funding a cars and truck to purchasing property, and then repay the lending according to their very own routine. Boundless financial provides lots of advantages. Here's a take a look at a few of them. Infinite Banking vs traditional banking.

Who can help me set up Whole Life For Infinite Banking?

Right here are the solution to some concerns you may have. Is limitless financial genuine? Yes, unlimited financial is a legitimate approach. It includes using an entire life insurance policy plan to develop a personal financing system. However, its efficiency depends upon various factors, consisting of the plan's structure, the insurance policy business's efficiency and exactly how well the approach is managed.

Just how long does boundless financial take? Boundless banking is a long-lasting approach. It can take numerous years, usually 5-10 years or even more, for the money worth of the policy to expand completely to start borrowing versus it properly. This timeline can differ relying on the policy's terms, the premiums paid and the insurance firm's performance.

How secure is my money with Cash Value Leveraging?

Long as premiums are current, the insurance policy holder merely calls the insurance business and demands a car loan versus their equity. The insurance company on the phone won't ask what the lending will certainly be used for, what the earnings of the customer (i.e. insurance holder) is, what other possessions the person might have to work as security, or in what timeframe the individual means to repay the finance.

In contrast to describe life insurance coverage items, which cover only the recipients of the policyholder in the occasion of their fatality, entire life insurance policy covers a person's whole life. When structured appropriately, whole life policies create an unique revenue stream that enhances the equity in the policy over time. For further analysis on just how this works (and on the pros and disadvantages of entire life vs.

In today's world, one driven by convenience of ease, usage many as well for granted our approved's country founding principlesStarting freedom and liberty.

What do I need to get started with Private Banking Strategies?

It is a principle that enables the insurance policy holder to take finances on the whole life insurance coverage policy. It needs to be offered when there is a minute monetary worry on the individual, in which such fundings may aid them cover the economic lots.

The insurance holder requires to link with the insurance policy company to ask for a lending on the plan. A Whole Life insurance policy can be labelled the insurance item that gives protection or covers the individual's life.

The policy may need monthly, quarterly, or annual repayments. It starts when a private occupies a Whole Life insurance policy plan. Such plans may spend in corporate bonds and federal government safeties. Such plans maintain their values due to their conservative approach, and such policies never ever invest in market instruments. Boundless financial is a concept that allows the insurance holder to take up lendings on the whole life insurance coverage plan.

How do I leverage Infinite Banking to grow my wealth?

The cash or the abandonment value of the whole life insurance policy functions as security whenever taken car loans. Expect a private enrolls for a Whole Life insurance policy plan with a premium-paying term of 7 years and a policy duration of 20 years. The specific took the policy when he was 34 years old.

The car loan rates of interest over the plan is fairly less than the traditional loan items. The collateral stems from the wholesale insurance coverage's cash money or surrender value. has its share of advantages and disadvantages in regards to its principles, application, and performances. These aspects on either extreme of the spectrum of realities are discussed below: Limitless financial as a monetary technology boosts money circulation or the liquidity account of the policyholder.

Infinite Banking

The insurance plan car loan can likewise be offered when the individual is jobless or encountering health issues. The Whole Life insurance coverage plan retains its overall value, and its performance does not connect with market efficiency.

Typically, acts well if one completely counts on financial institutions themselves. These principles function for those who possess strong financial money flows. Additionally, one should take only such plans when one is financially well off and can handle the plans costs. Boundless banking is not a scam, however it is the ideal thing the majority of people can choose to improve their economic lives.

What type of insurance policies work best with Leverage Life Insurance?

When individuals have boundless financial discussed to them for the initial time it appears like a wonderful and safe means to grow wide range - Privatized banking system. The concept of replacing the hated bank with loaning from on your own makes a lot more sense. Yet it does need changing the "despised" bank for the "despised" insurance provider.

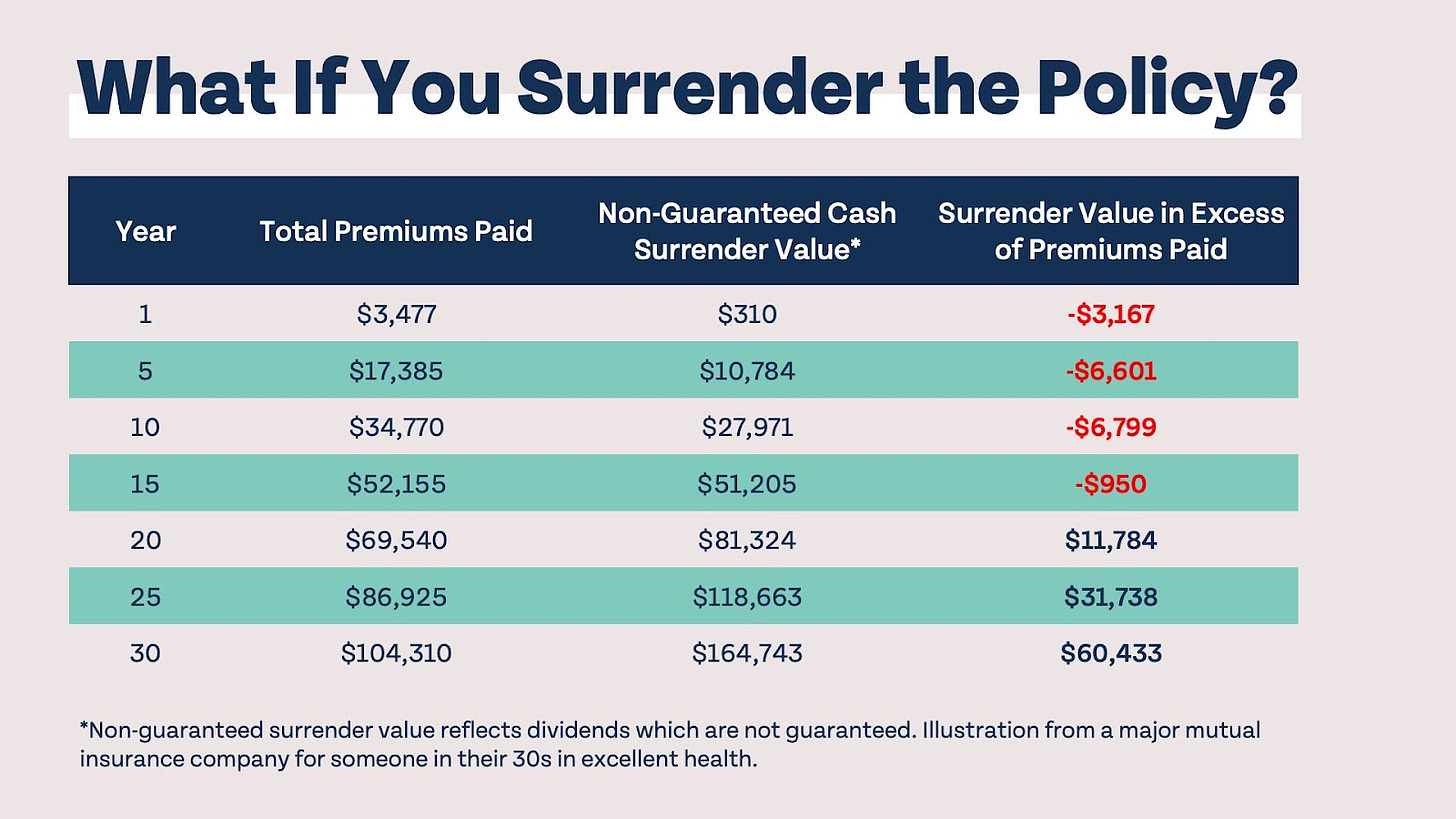

Obviously insurance provider and their representatives like the principle. They designed the sales pitch to offer more whole life insurance. Yet does the sales pitch meet actual world experience? In this short article we will certainly first "do the mathematics" on unlimited banking, the bank with on your own philosophy. Due to the fact that followers of boundless financial might declare I'm being prejudiced, I will certainly use display shots from a supporter's video and link the entire video at the end of this article.

Through Infinite Banking, business owners gain access to tax-free capital. infinite banking.

Policy loans provide easy access to capital, ensuring full financial autonomy.

Financial experts can optimize policies for maximum growth. Discover how to integrate Infinite Banking into your business to take advantage of tax-free capital.

There are no items to buy and I will market you nothing. You maintain all the cash! There are 2 significant financial calamities developed into the boundless banking principle. I will expose these flaws as we resolve the math of just how unlimited financial really functions and exactly how you can do better.

Latest Posts

Bank On Yourself Scam

Infinite Banking Concepts

The First Step To Becoming Your Own Banker