All Categories

Featured

Table of Contents

A PUAR enables you to "overfund" your insurance coverage right as much as line of it ending up being a Changed Endowment Contract (MEC). When you make use of a PUAR, you swiftly raise your money value (and your death benefit), therefore increasing the power of your "financial institution". Additionally, the even more cash money worth you have, the better your interest and dividend payments from your insurance provider will be.

With the rise of TikTok as an information-sharing platform, financial guidance and techniques have actually found a novel method of spreading. One such strategy that has actually been making the rounds is the boundless financial concept, or IBC for short, gathering endorsements from celebrities like rapper Waka Flocka Fire. Nevertheless, while the method is presently preferred, its roots map back to the 1980s when economist Nelson Nash presented it to the globe.

What is the long-term impact of Self-banking System on my financial plan?

Within these policies, the cash money worth expands based on a rate established by the insurance firm (Tax-free income with Infinite Banking). As soon as a substantial cash worth gathers, insurance policy holders can obtain a cash worth loan. These car loans vary from conventional ones, with life insurance acting as security, implying one can lose their insurance coverage if loaning excessively without sufficient cash worth to support the insurance policy costs

And while the allure of these plans is noticeable, there are natural limitations and risks, demanding attentive cash money value surveillance. The technique's legitimacy isn't black and white. For high-net-worth people or company owner, especially those using techniques like company-owned life insurance policy (COLI), the advantages of tax breaks and substance development can be appealing.

The attraction of unlimited financial doesn't negate its difficulties: Price: The fundamental demand, a long-term life insurance policy, is costlier than its term counterparts. Eligibility: Not everybody gets whole life insurance because of strenuous underwriting procedures that can omit those with details health and wellness or way of living conditions. Complexity and threat: The complex nature of IBC, coupled with its dangers, might deter several, especially when simpler and much less dangerous options are offered.

How do I qualify for Infinite Banking Wealth Strategy?

Assigning around 10% of your month-to-month income to the plan is just not practical for lots of people. Making use of life insurance as a financial investment and liquidity resource calls for discipline and tracking of policy money worth. Seek advice from a monetary advisor to establish if boundless financial straightens with your concerns. Part of what you read below is merely a reiteration of what has already been said above.

Setting up an Infinite Banking system requires the right whole life insurance policy.

A well-designed policy ensures full liquidity that enhance long-term financial security.

Next, policyholders can borrow against their policy for investments. Speak with an Infinite Banking consultant today to develop a custom Infinite Banking system.

So prior to you obtain into a situation you're not gotten ready for, know the complying with first: Although the principle is commonly offered thus, you're not really taking a car loan from on your own. If that were the case, you wouldn't need to settle it. Rather, you're obtaining from the insurer and need to repay it with rate of interest.

Some social media messages recommend using cash value from entire life insurance coverage to pay down credit report card debt. When you pay back the car loan, a portion of that passion goes to the insurance policy firm.

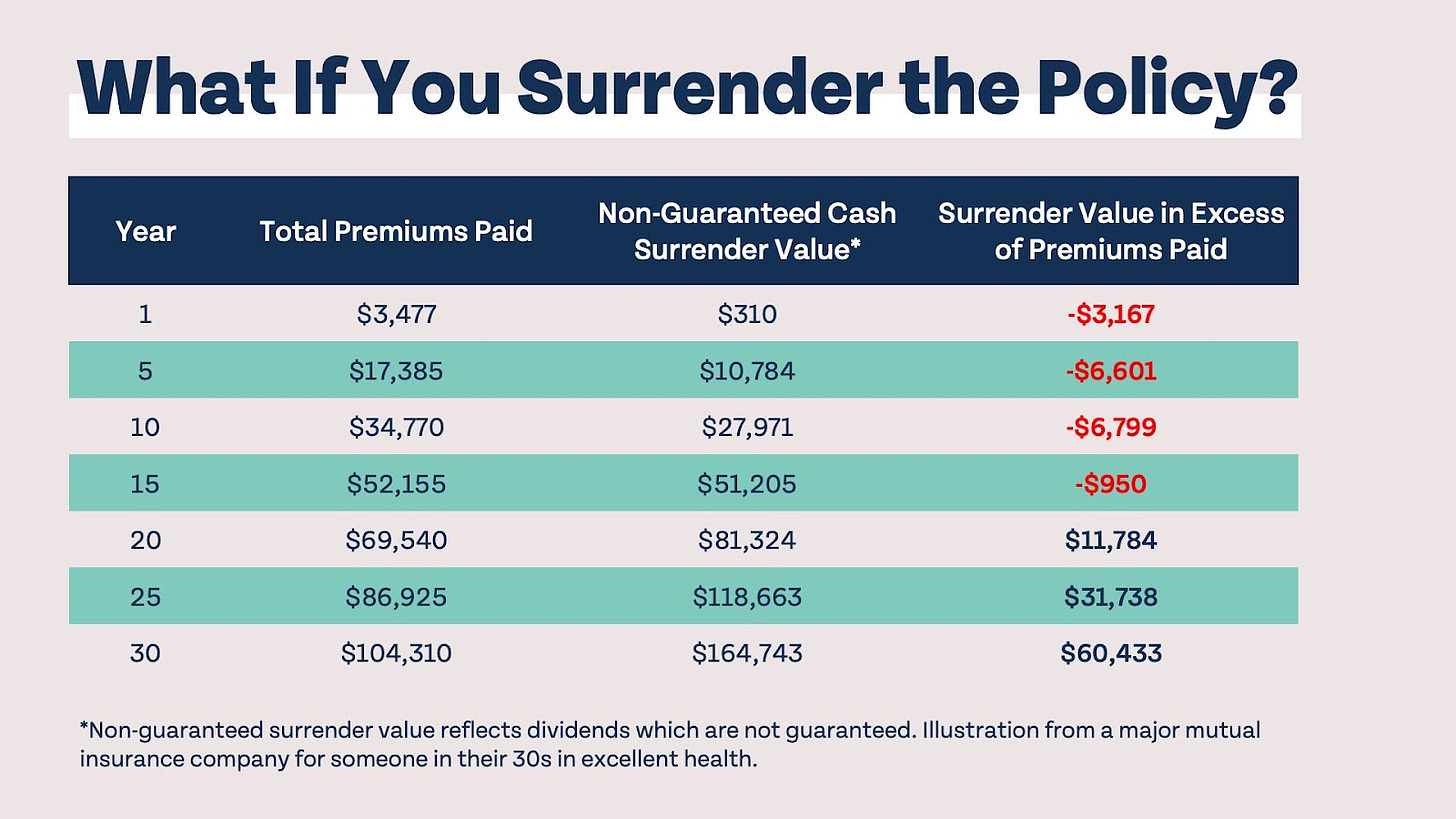

For the initial numerous years, you'll be paying off the compensation. This makes it very challenging for your policy to build up value during this time around. Entire life insurance policy costs 5 to 15 times much more than term insurance coverage. Most people simply can not manage it. So, unless you can pay for to pay a couple of to several hundred dollars for the next decade or more, IBC won't function for you.

Can Cash Value Leveraging protect me in an economic downturn?

Not every person should rely only on themselves for economic safety and security. If you need life insurance policy, below are some valuable pointers to consider: Think about term life insurance. These policies give protection throughout years with substantial economic obligations, like home loans, trainee financings, or when looking after young youngsters. Ensure to go shopping about for the ideal price.

Visualize never ever having to worry concerning financial institution finances or high passion rates again. What happens if you could obtain money on your terms and construct wide range at the same time? That's the power of infinite financial life insurance policy. By leveraging the money value of whole life insurance policy IUL policies, you can grow your wealth and borrow money without depending on conventional financial institutions.

There's no collection lending term, and you have the liberty to determine on the repayment routine, which can be as leisurely as repaying the loan at the time of death. Self-financing with life insurance. This adaptability expands to the maintenance of the financings, where you can select interest-only payments, maintaining the loan equilibrium level and manageable

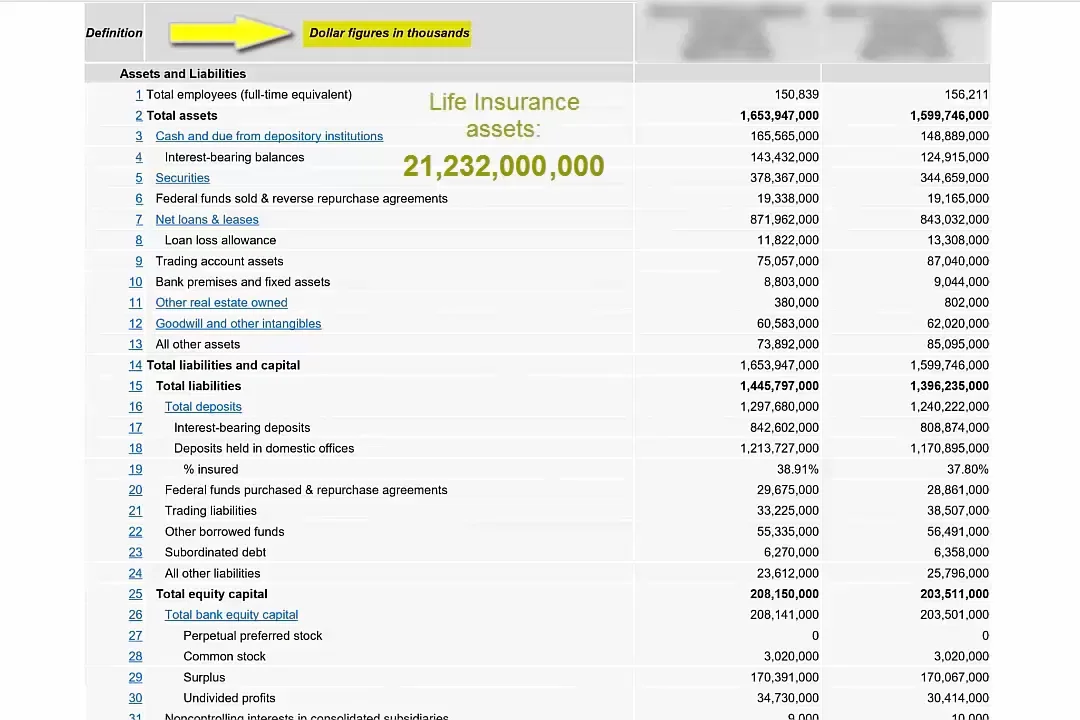

Holding money in an IUL fixed account being attributed interest can often be better than holding the cash on deposit at a bank.: You have actually constantly dreamed of opening your very own bakery. You can borrow from your IUL plan to cover the initial expenses of leasing a space, acquiring tools, and hiring staff.

Wealth Management With Infinite Banking

Individual car loans can be gotten from conventional banks and lending institution. Here are some key points to consider. Charge card can give an adaptable means to borrow money for really temporary periods. Nevertheless, borrowing money on a charge card is generally very expensive with interest rate of passion (APR) typically reaching 20% to 30% or even more a year - Tax-free income with Infinite Banking.

Latest Posts

Infinite Banking Nelson Nash

How does Infinite Banking Wealth Strategy compare to traditional investment strategies?

Wealth Management With Infinite Banking